oklahoma car sales tax rate

Some have no sales tax while some states have high sales tax rates above 10. Used vehicles are taxed a flat fee of 20 on the first 1500 of the purchase price and the standard 45 combined tax rate for the remainder of the balance.

OK State Sales Tax Rate.

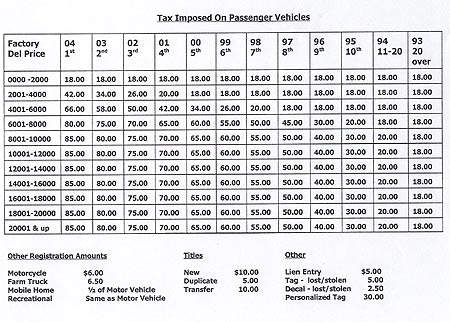

. There is also an annual registration fee of 26 to 96 depending on the age of the. 31 rows The state sales tax rate in Oklahoma is 4500. In addition to taxes car purchases in Oklahoma may be subject to other fees like.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. The amount you pay in sales tax will depend on where the car is. Maximum Possible Sales Tax.

The excise tax is 3 ¼ percent of the value of a new vehicle. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top. Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price.

225 lower than the maximum sales tax in OK. Just enter the five-digit zip code of the location in. Oklahomas sales tax rates for commonly exempted items are as follows.

Maximum Local Sales Tax. Until 2017 motor vehicles were fully exempt from the sales tax but under HB 2433 the exemption was partially lifted and motor vehicles became subject to a 125 percent sales tax. The cost for the first 1500 dollars is a flat 20 dollar fee.

This is the total of state county and city sales tax rates. The Tulsa sales tax rate is. 325 excise tax plus 125 sales tax 45 total for new vehicles.

Average Local State Sales Tax. In that the new car tax was clearly passed exclusively for the. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The Oklahoma Tax Commission estimated that government revenue decreased by 50 million from this change. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. In Oklahoma this will always be 325.

For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. The OK sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction.

Oklahoma residents are subject to excise tax on vehicles all terrain. The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a. For example imagine you are purchasing a vehicle for 50000 with the state sales tax of 325.

OKLAHOMA CITY Several Oklahoma lawmakers are celebrating a victory following a recent ruling by the Oklahoma Supreme Court. Excise tax is collected at the time of issuance of the new Oklahoma title. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

2433 as a part of the states budget that will effective July 1 this year impose a 125 percent sales tax on vehicles of all weights. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Oklahoma State Sales Tax.

Oklahoma charges two taxes for the purchase of new motor vehicles. This method is only as exact as the purchase price of the vehicle. Excise tax is often included in the price of the product.

The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325. This is only an estimate. The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325.

The value of a vehicle is its actual sales price. The result appears to be a 125 percent rate plus 10 for vehicles with a gross weight over 55000 pounds and trailers and. States with high tax rates tend to be above 10 of the price of the vehicle.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. 125 sales tax and 325 excise tax for a total 45 tax rate. Motor Vehicle CARS - Online Renewal Find a Tag Agent Forms Publications Specialty License Plates Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption.

The Oklahoma sales tax rate is currently. Oklahoma collects a 325. OK Combined State Local Sales Tax Rate avg 7724.

The 2018 United States Supreme Court decision in South Dakota v. The Oklahoma sales tax rate is 45 as of 2022 with some cities and counties adding a local sales tax on top of the OK state sales tax. Select the Oklahoma city from the list of popular cities below to.

The Oklahoma sales tax rate is currently. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. The Tulsa sales tax rate is.

The annual registration fee for non-commercial vehicles ranges from 15 to 85 depending on the age of the vehicle. Wayfair Inc affect Oklahoma. Registration fees are.

Did South Dakota v. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. The County sales tax rate is.

Multiply the vehicle price after trade-ins and incentives by the sales tax fee. On May 31 2017 however Oklahoma Governor Fallin approved legislation HB. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition.

Oklahoma has recent rate changes Thu Jul 01 2021. How much is the car sales tax rate in Oklahoma. With local taxes the total sales tax rate is between 4500 and 11500.

125 sales tax and 325 excise tax for a. Excise tax is assessed upon each transfer of vehicle all terrain vehicle boat or outboard motor ownership unless specifically exempted by law.

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Multistate Sales Tax State Rates Wolters Kluwer

Appropriations History Oklahoma Policy Institute

State And Local Tax Distribution Oklahoma Policy Institute

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Missouri Car Sales Tax Calculator

![]()

Car Sales Tax In Oklahoma Getjerry Com

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

How To Sue A Car Dealer For Misrepresentation Findlaw

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

What S The Car Sales Tax In Each State Find The Best Car Price

What S The Car Sales Tax In Each State Find The Best Car Price

Tesla Asks Fans In Oklahoma And Mississippi To Fight New Bills To Ban Direct Sales Of Electric Cars Electrek